If you are interested in the Set for Life book by Scott Trench or want a little recap of its main takeaways, this post is for you.

First, let’s have a look at the 3 main parts composing this book. Then we will follow with a book review and why you should check it out.

1. Save $25,000

This is the first step in the Set for Life plan.

Scott Trench argues you should start with saving a substantial amount of money to obtain a first level of financial freedom. This should come before the next fun steps like investing, house hacking, or income scaling.

In the book’s first part, he channels your effort on saving money and living a frugal lifestyle. This should take precedence over increasing your income.

He argues that lowering your expenses increases your after-tax money, compared to getting a second salary you will have to pay tax on.

One dollar saved is one dollar more in your pocket. One dollar earned might only be 70 or 80 cents more in your pocket after tax.

His tips are simple yet efficient:

- Track your money

- Cut off the unessential or what is not bringing you value

- Focus on your big expenses like rent and commute and work on lowering those first

He goes into great detail for that last tip.

Lower your biggest expenses for the biggest impact

Most people will rent an expensive apartment in a trendy part of town and commute one to two hours every day in their fancy car fueled with expensive gas.

Instead, try living closer to your work to cut down on commute expenses and rent an apartment with roommates to lower your living costs.

Make sure to save big money every month to reach your goal of saving $25,000 in one or two years, before jumping to the next step.

For more personal finance goals, check out this post to discover the 4 financial goals you should have.

2. Scale your income to $100,000

The author reminds you to not jump straight to the fun part of increasing your income. The $25,000 gives security during transitional times and allows you to start investing to build up your income.

Turning your biggest expense into an income producing asset

Scott Trench’s favourite investment seems to be in real estate. He strongly advocates for house hacking.

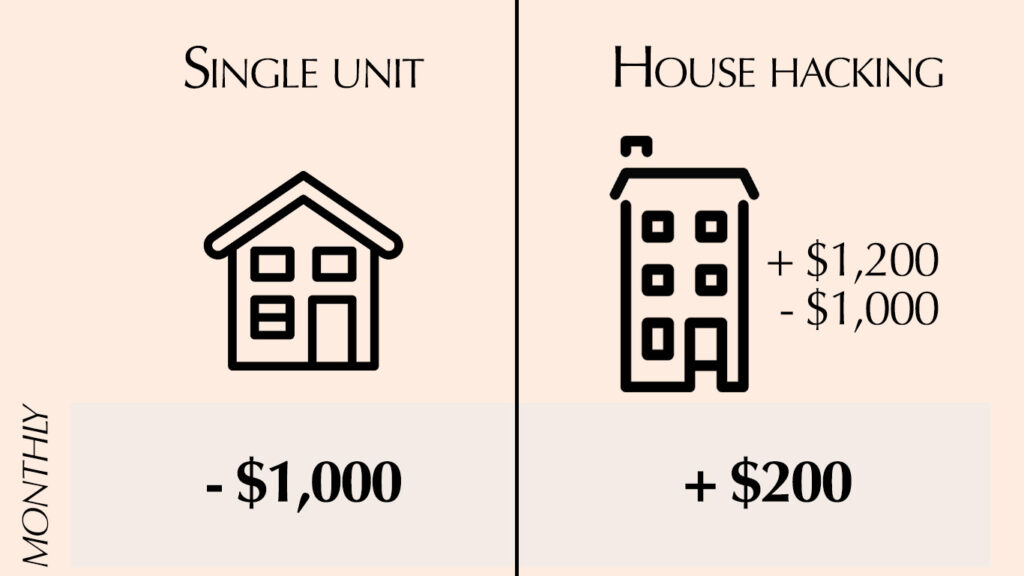

House hacking is when you buy a multiple unit property to use in part as your primary residence. You live in one of the units and have renters from the other units pay your mortgage and expenses.

For example, that would look like buying a house divided into two apartments.

Your mortgage might be $1000 a month. You are renting one of the apartments for $1200 while living in the other unit.

That way, your rental income covers your monthly mortgage payment, and you can lower your expenses drastically.

Get a job with a scalable income

This book doesn’t advise people to take on a side hustle.

Most of your productive awake hours are spent at work. Finding a job with a scalable income is way more effective than trying to cram in extra work during your less productive free time.

Instead, the book advises finding a career with a scalable salary such as sales. Fixed salaries are low or inexistent and you are paid proportionally to your results.

Scalable income:

more work = more money

Non-scalable income:

more work = same results

This is one particular idea from the book that stroke me. Most jobs in companies pay you for “butt time”.

The person that puts in twice the amount of work as everyone else isn’t paid twice as much, they’re not even promoted twice as fast.

The company has the team’s best interest at heart, not individuals.

You have to find a work where the effort put in produces more results.

But remember that this is possible thanks to the $25,000 security cushion previously built, as changing careers or jobs might result in a pay cut in the beginning.

Hopefully with time and hard work you’ll be able to scale your income to $100,000 and more, before moving on the the next step of the Set for Life book.

3. Reach financial freedom

The third part of the Set for Life book is about using what you learnt thus far to achieve financial freedom through investing.

He touches on investing in stocks and some more real estate investments.

Trench also dedicates a whole chapter on 10 habits and their impact on financial freedom.

Here are 10 habits to cut out of your life to be financially free

- TV and Netflix: they do not bring you closer to your goals. This has a high opportunity cost

- Sports entertainment: keep it only in moderation instead of it taking over so much of your free time

- A luxury residence far from work: it takes time, energy and money to set up and maintain a luxury residence

- Eating out: sharing a meal with someone who can help you achieve your goals is a great investment. However, eating out by yourself or with the same people over and over again doesn’t not bring much value to your life

- Social media: use these networks as part of your work. But don’t let them distract you from your goals

- Music at work: try swapping it with an audiobook or podcast to develop a skill or improve yourself

- Nightlife: going out after midnight once in a while probably won’t hurt your progress, but this is not helping you in any way apart from recreation. Trench argues a daily nightlife has no place in the life of an aspiring early retiree

- Shopping: some items can improve greatly your productivity or quality of life. However, don’t spend a considerable amount of time comparing very similar options. Shopping aimlessly is a waste of time and money

- The snooze button: get out of bed the first time your alarm goes off. Waking up is a mindset. Snoozing for more won’t help and will probably hurt your energy levels

- The “I want to try to do everything” mentality: commit to a project that will make an impact on the world or that will lead you to success. Pick a few things you love and become an expert.

The Set for Life book review

This is a valuable resource for anyone willing to put in the work to achieve financial freedom.

The author’s opinion is not always attractive. He supports saving your after-tax money by living frugally, investing that money wisely and taking pay cuts if necessary to play the long game.

No get-rich-quick scam, but an efficient step by step formula to reach financial freedom through hard work and consistency.

I loved the real and concrete tips given in this book and how it pushes the reader to do as much work as possible now to enjoy more freedom and fulfilment later.

Although reaching financial freedom will take a few years, Trench urges the reader to not wait for retirement nor 20 years down the line.

Since reading this book, I’ve been implementing some of its content into my life and am definitely more aware of investment opportunities and how to create the life I desire.

Check the Set for Life book out, apply its key takeaways and reach financial freedom.

Be consistent in your effort, work hard and you can literally achieve anything you put your mind to.